Stocks have climbed a mountain of worries this year, ranging from lingering inflation to bank collapses to the possibility that the U.S. Congress might just decide not to pay its bills. But has the run, also fueled by excitement over artificial intelligence, gone too far?

That’s the suggestion of Tom DeMark, who was recently celebrated by the technical analysis CMT Association and is the founder and CEO of DeMark Analytics. He focuses on the number of days — which don’t have to be consecutive — that there was a close lower than the low of two days ago. Subject to various conditions, when the countdown reaches 13, a buy signal is triggered. (The opposite is the case on the way up.)

In an email to MarketWatch, DeMark, who has advised investing legends including Paul Tudor Jones, Leon Cooperman and Steven A. Cohen, says the Nasdaq 100

QQQ,

has been in an extended uptrend, but now it’s likely approaching exhaustion. See DeMark’s analysis on his website Symbolik.

DeMARK Analytics

He says a Nasdaq 100 ’13’ top will need both a higher high, as well as a higher close, than Tuesday’s levels.

“This will be the first time this year Nasdaq 100 time and price trend exhaustion components should be in sync with one another. Once they align, a subsequent close less than both the closes 4 and 5 days prior should confirm the nascent downtrend,” says DeMark.

He also identifies another change. He says the five-plus months of Nasdaq 100 outperformance over the S&P 500 is about to reverse. “Once two additional higher closes are recorded, sell countdown 13 will be recorded,” DeMark says.

Not that it’s necessarily good news for the S&P 500

SPX,

or the SPY exchange-traded fund

SPY,

tracking it. “Currently, SPY is sell countdown 11 and requires two successively higher highs and closes greater than the February 2 high to record a ‘possible’ market top which must then be confirmed” by related markets.

DeMARK Analytics

The VIX

VIX,

volatility index, he says, may be able to move higher. “VIX is both sequential and combo buy countdown 12 and with an upcoming new low close should record buy countdown 13. Typically, markets respond to VIX 13’s within 1-3 trading days after 13 is recorded,” he says.

DeMARK Analytics

The markets

U.S. stock futures

ES00,

NQ00,

were pointing higher after Tuesday’s weaker finish. Gold futures

GC00,

were below $2,000 an ounce. The yield on the 10-year Treasury

TMUBMUSD10Y,

was 3.52%.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

House Speaker Kevin McCarthy said a debt-ceiling deal could be reached as early as this week as President Joe Biden cut short an upcoming foreign trip. “[Tuesday’s] meeting between President Biden and House Speaker McCarthy went as well as could have reasonably been hoped for,” said economists at Citigroup.

Target

TGT,

and after the close Cisco Systems

CSCO,

highlight the day’s earnings releases. Target issued a warning about theft and organized crime denting results.

Western Alliance Bancorp

WAL,

said its deposits rose by $2 billion during the second quarter, news that lifted its shares as well as other regional lenders including PacWest

PACW,

UBS

UBS,

estimates it will book a $35 billion gain from buying its fallen rival Credit Suisse.

Best of the web

Jeffrey Epstein helped famed academics Noam Chomsky and Leon Botstein with their finances.

Aging populations are already denting the credit ratings of governments.

‘Welcome to the automobile business.’ Here’s Jim Chanos on Elon Musk’s Tesla

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

XELA, |

Exela Technologies |

|

MULN, |

Mullen Automotive |

|

AAPL, |

Apple |

|

BUD, |

Anheuser-Busch InBev |

|

AMZN, |

Amazon.com |

|

NVDA, |

Nvidia |

|

NIO, |

Nio |

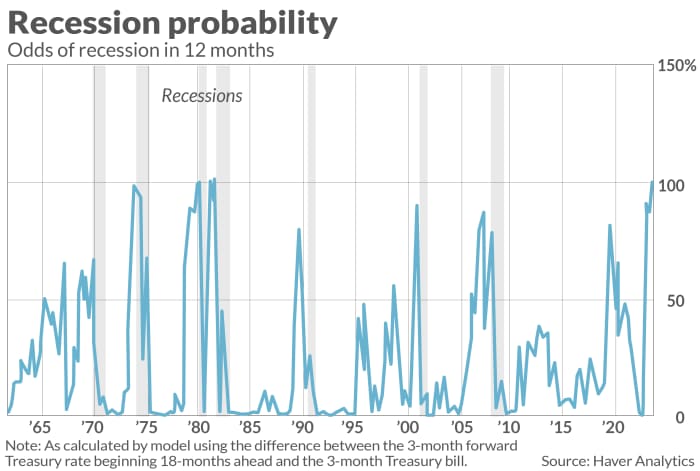

The chart

There are a variety of indicators forecasting the U.S. to enter a recession — but this market implied gauge has reached 99%. The model uses the difference between the 3-month forward Treasury rate beginning 18-months ahead and the 3-month Treasury bill to estimate the probability of a recession in the United States 12 months ahead.

Random reads

The decade-long plan to bring giant Frenchman Victor Wembanyama to NBA glory.

This woman had a lifelong dream to get knives thrown at her, which she realized aged 99.

These $25 jars at a thrift store turned out to be Qing dynasty treasures.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

This story originally appeared on Marketwatch