There’s an old Yiddish expression, “Man plans and God laughs,” that seems especially apt for retirement.

You may have saved up for that stage of life and thought through what you’ll do with your newfound free time. But odds are, you’ll wind up facing what a new retirement study from the financial services firm Edward Jones and the Age Wave research and consulting firm calls “cannonballs” and “curveballs.”

The trick is figuring out how to deal with them when they occur and, when possible, dodging them before they happen.

“Making those course corrections really allows you to live an active, engaged, purposeful life,” said Lena Haas, head of wealth management advice and solutions at Edward Jones, on the “Friends Talk Money” podcast I co-host with Terry Savage and Pam Krueger.

Resilient choices for retirement

Haas was one of the creators of that Edward Jones/Age Wave research report, “Resilient Choices: Trade-offs, Adjustments, and Course Corrections to Thrive in Retirement.”

In a webinar discussing the report’s findings, Age Wave chief executive and founder Ken Dychtwald said: “The challenges are real, but the population is pretty clever in thinking of what they can do to avert these crises.”

The report is based on surveys the two companies conducted with more than 12,000 people — many of them retirees and pre-retirees — from January through March 2023.

“Most of us experience those curveballs, which are relatively minor derailers, and cannonballs, which are major setbacks, that happen during the course of retirement or leading to retirement,” said Haas. “Retirement is not a static journey, it’s a very dynamic journey.”

How common are cannonball events in retirement?

In fact, her study found, 75% of retirees have experienced a cannonball event — women more than men.

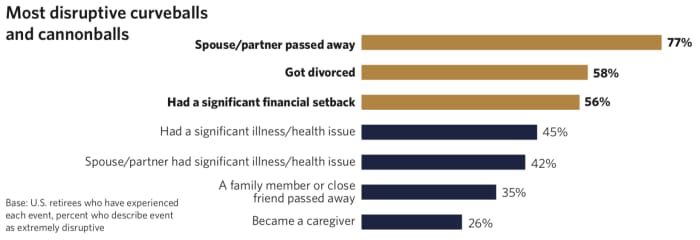

The most common ones: death of a family member or close friend, personal health issues, coping with a spouse’s or partner’s health issues and significant financial setbacks.

Edward Jones, Age Wave

About a third of retirees surveyed said they were forced to retire unexpectedly due to a job loss or a health problem they or their spouse or partner had.

In another recent study, the National Council on Aging learned that 80% of people 60 and older lack the financial resources to cover long-term care services or another financial shock. Yet one in seven older adults will require such care for more than five years.

Savage, a personal-finance columnist and author, said there’s another word for these cannonballs and curveballs: Life.

Among the best ways to avoid curveballs that can lead to unhappiness in retirement, the Edward Jones/Age Wave report found, was to avoid spending time in toxic relationships.

“Spending time with those you enjoy will bring you the joy,” Haas said.

Edward Jones, Age Wave

Retirement cannonballs with the biggest impact

The retirement cannonballs with the biggest impact, the Edward Jones and Age Wave researchers found: Widowhood and divorce.

“In our focus groups, you could just hear the emotion about those,” said Haas.

The Center for Retirement Research at Boston College has concluded that divorce substantially increases the likelihood of being at risk, financially, in retirement.

Krueger, CEO and founder of the financial adviser vetting firm Wealthramp, noted on “Friends Talk Money” that the pandemic was a huge cannonball for pre-retirees and retirees.

“The point is: ‘How do I build cannonballs like a depressed stock market into my financial planning, knowing that these things can easily derail me? How am I going to react?’” she said.

People who reacted to the 2008-09 financial crisis by pulling their money out of the market, Krueger added, “missed the biggest and strongest bull market in the history of the stock market.”

Financial course corrections that work

Haas said some of the most effective financial course corrections retirees and pre-retirees have taken are reducing debt and lowering expenses.

“The word that came up over and over again was ‘frugality,’” Haas said. “In the past, frugality had a negative connotation, maybe meaning ‘cheap.’ But we heard people talking about frugality, meaning being deliberate and smart.”

So, she advised, examine your retirement budget and see how you can manage it effectively. Practice living on a slimmed-down retirement budget before you retire, Haas suggested.

Pre-retirees may be able to avoid the cannonball of running out of money in retirement by working longer and saving more, if they can.

The Edward Jones/Age Wave study cited a hypothetical pre-retiree couple, both 62, who each decided to work five more years — the wife switching to working 30 hours a week while continuing to fund her 401(k) and getting the company match; the husband becoming an independent consultant. Both delayed claiming Social Security to 67.

“The amount of extra financial security for them was absolutely staggering,” said Haas.

Retired women have made fewer proactive financial course corrections (like reducing debt, developing a financial plan or adjusting an investment mix) than men, the Edward Jones/Age Wave survey found.

You may want to hire, or work with, a financial adviser to better avoid financial cannonballs and curveballs in retirement or to recalibrate after they arrive, said Savage.

Volunteering as a course correction

Volunteering in retirement, Haas said, can be a great course correction if you struggle finding meaning and purpose.

“Doing good is good for you,” she added. “People who volunteer just a few hours a week report that they’re happier, more resilient and healthier.”

I’ve found that to be true in my unretirement. By volunteering weekends at Furniture Assist, in Springfield, N.J., I’ve grown happier. The physical exertion from carting items from the furniture warehouse to people’s trucks and transporting pieces from people’s cars to the warehouse has kept my heart pumping, too.

One problem some retirees have, Dychtwald said: Knowing how to find the right volunteering match.

What millennials think about their parents’ retirement

The Edward Jones/Age Wave survey also had some eyebrow-raising findings when millennials were asked about the retirements of their parents.

Two-thirds of millennials surveyed were concerned their parents or in-laws might not have enough money to live on in retirement. “That’s a pretty staggering number,” said Haas. And 61% of the millennials said they worry their parents will become financially dependent on them.

When the adult children were asked whether they’d prefer their parents have financial security or leave them more inheritance, “83% said, ‘Never mind our inheritance. We just want our parents to have financial security and live well,’” noted Haas.

The millennial kids had some advice for their parents, and it was not unlike what boomer and Generation X parents often tell their children: Save more money for the future and stay physically active. The children also encouraged parents to try staying mentally sharp, try out new hobbies and activities and spend more time with friends.

The windfalls of retirement

Not everything that happens in a retirement is a cannonball or a curveball, though, the Edward Jones/Age Wave researchers found. Far from it.

“We saw that over 80% of retirees also experienced happy, unexpected windfalls,” said Haas. These windfalls weren’t just financial; some were psychic, too.

One was spending more time with your family.

“It unlocks so much in terms of emotional well-being and physical well-being,” said Haas. “One of the greatest windfalls retirees indicated to us is having grandchildren.”

As it turns out, that’s the windfall coming my way this September and I can’t wait.

This story originally appeared on Marketwatch